Fraudulent SMS activity

We have observed a fraudulent activity whereby forged messages are being circulated in the name of AnandRathi -company. These messages contain trading recommendations/calls which are sent to public in form of SMSs in the company’s name and style of communication.

AnandRathi strongly advises its clients, not to trade on such calls and beware of such unscrupulous communications. Be assured, that the company will never recommend you to trade with specific quantities or promise fixed earnings.

This activity has been reported to the relevant authorities and is currently under investigation.

If you come across any such communication, immediately report it to us by sending the screen shots of such SMSs and emailing it to smscomplaint@rathi.com.

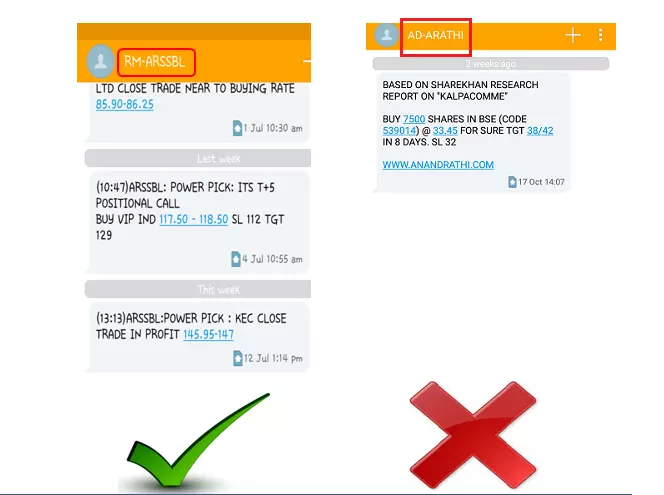

Please refer to the snapshots provided below of such fraudulent messages vis-à-vis Anand Rathi's genuine trading calls via SMS.

Note:

Note:o The correct SMS ID used for sending any trading recommendations/calls is “ARSSBL”.

o The SMS ID “ARATHI” is only used for sending trade confirmations & holding position related SMSs and not for any trading recommendations/calls.