Insurance Broking Firm in India

AnandRathi is also one of the largest Insurance broking firms in India is licensed by IRDA to act as a broker for Life as well as Non Life insurance sector. We serve as a distribution partner to all major insurance companies with a wide range of insurance product offerings.

Why choose us?

With the right experience, expertise and clients’ trust, makes AnandRathi a preferred choice for Life Insurance needs. Every Client is offered an optimal alternative available in the market, ensuring that all the insurance requirements of the Clients are covered in that solution.

HEALTH INSURANCE

Why Health Insurance?

Health is an integral part of our lives. Hence it is imperative for individuals to protect their health and also insure it against any unforeseen situations which might incur huge medical expenses. Keeping this in mind, the Health insurance services offered at AnandRathi are quiet in line with the decision that needs to be taken by the clients when it comes to Health/Medical Insurance.

Why choose us?

At AnandRathi, a dedicated team looks after the insuree’s needs and ensures that the insurance solution provided meets its requirement in an optimal manner.

Clients’ and their family’s needs is the prime focus for us when it comes to offering a solution. Hence one can be assured of a suitable and convenient plan that we propose to them.

GENERAL INSURANCE

General insurance is typically defined as any insurance that is not determined to be life insurance.

Why choose us?

At AnandRathi we provide a wide range of General Insurance products that suit Client’s requirements. We offer research based advice which helps to secure and protect the assets from a calamity or disaster. Our solution is backed by a technical team of meticulous experts and is quite capable of handling both large insurance portfolios as well as retail Clients.

Our Cover recommendations are made only after accomplishment of inspections, scrutiny of existing insurance portfolio and ascertain areas for optimization of cover and pricing.

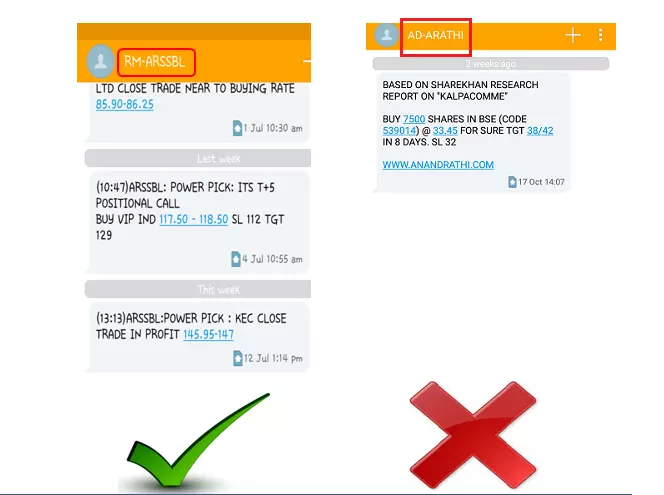

Note:

Note: