Derivative Trading for Advance Investments

Derivative trading in the Indian stock market involves trading contracts whose value is derived from underlying assets like stocks, indices, currencies, or commodities. These contracts, primarily futures and options, allow investors to speculate on the future price movements of these assets without actually owning them.Futures contracts obligate the buyer to purchase or the seller to sell the underlying asset at a predetermined price and date, while options contracts grant the buyer the right, but not the obligation, to buy or sell the asset at a specific price within a certain timeframe. This market provides opportunities for hedging against potential losses in the cash market, leveraging investments for potentially suitable returns, and employing various trading strategies to capitalise from market fluctuations.

Investors should consider derivative trading for several reasons. Firstly, it offers a powerful tool for risk management through hedging. By using derivatives, investors can offset potential losses in their existing stock portfolios due to market downturns. Secondly, derivatives provide leverage, enabling investors to control a larger amount of assets with a smaller capital outlay, potentially amplifying profits. However, it's crucial to acknowledge that leverage also magnifies losses. Lastly, the derivatives market offers a wider range of trading strategies compared to traditional stock trading, allowing sophisticated investors to capitalise from various market conditions, such as volatility or sideways trends. However, it's important to note that derivative trading requires a deep understanding of market dynamics and risk management, making it more suitable for experienced investors.

RESEARCH

Our dedicated research team publishes "First Morning Technical and Derivatives", a daily report that includes an in-depth Derivative market study covering all available databases. This report includes:-

• View and Trading Levels of Nifty and Bank Nifty.

• Stock ideas.

• Open interest activities.

• FII data.

• Options data.

• Derivative indicators.

A monthly report i.e. "Derivatives, Rollover, Outlook and Strategy", is also released at the start of every new series. This report contains the monthly outlook of Nifty and Bank Nifty, Rollover Data for the entire series and stock trends according to the rollover, Apart from this, corporate action in F&O stocks and view for the coming series is also provided in.

RECOMMENDATIONS

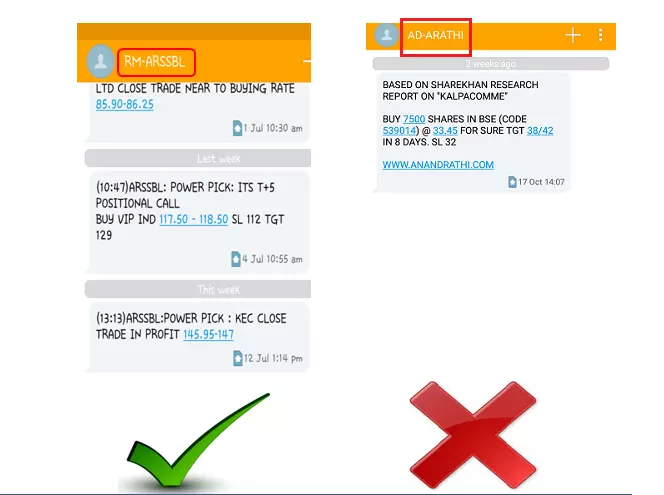

AnandRathi offers a basket of all the Derivative trading ideas including intraday trades to monthly position expiry call on stock and indices with a better accuracy and risk-reward ratio.

INVESTOR AWARENESS

Frequent Client workshops and investment seminars are organized at regional and branch level for knowledge sharing, investor awareness and to provide appropriate guidance during any phase of the market.

Note:

Note: