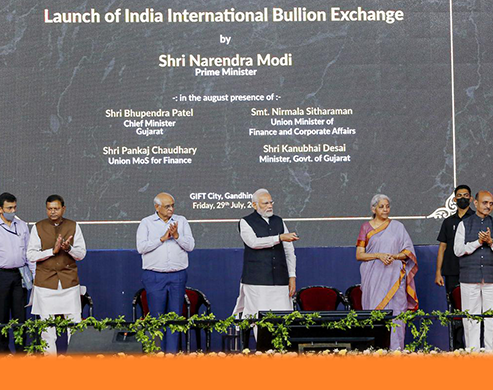

India International Bullion Exchange (IIBX)

India's bullion market is one of the largest in the world, the second largest in terms of consumption and holds an important position globally, but it lacks organization and structure. A bullion spot exchange is expected to address these challenges and eliminate market inefficiencies. As a prominent market, India has always aspired to be a price setter for the bullion.

IIBX is India’s first International Bullion Exchange set up at the GIFT City, Gandhinagar. IIBX offers a diversified portfolio of products and technology services at a cost which is far more competitive than the Indian exchanges as well as other global exchanges in Hong Kong Singapore, Dubai, London and New York.

Jewelers and bullion dealers with a net worth of Rs 25 Crores will be able to choose their own suppliers of gold and buy the precious metal from them through the India International Bullion Exchange (IIBX) in GIFT City.

IIBX is regulated by the International Financial Services Centres Authority (IFSCA). The IFSCA was been established on April 27, 2020 under the International Financial Services Centres Authority Act, 2019. Headquartered at GIFT City, Gandhinagar in the state of Gujarat, the IFSCA is a unified authority for the development and regulation of financial products, financial services and financial institutions.

Customer Criteria

IIBX aims to cater Gold refineries, Institutional Investors, Bullion Dealers, Banks and Exporters

Qualified Individual

Person resident outside India having net worth less than USD 250000 or any other equivalent currency, which may be determined in such a manner as specified by the Authority. (Net worth certificate shall not be older than 3 months and shall be provided by the individual chartered accountant firm to the trading member.

Corporate or institutional

Person resident outside India who are corporate or institutional entities having net worth USD 500,000 or any other equivalent foreign currency, is the manner as maybe specified by the Authority.

Qualified Jeweller Criteria

The entity shall be engaged in the business of goods falling under ITS(HS) codes 7108, 7113, 7114 and 7118 under Chapter 71 of ITC(HS)

- The entity shall have a minimum net worth of ₹ 25 crore as per its latest audited financial statement.

- The entity must have filed due GST returns up to the preceding month prior to making an application to the IIBX

- 90% of the average annual turnover in the last 3 financial years are through dealing in goods under precious metals.

| HSN CODE | ACTIVITY |

|---|---|

| 7108 | Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coin |

| 7113 | ARTICLES OF JEWELLERY AND PARTS THEREOF, OF PRECIOUS METAL OR OF METAL CLAD WITH PRECIOUS METAL - Of precious metal whether or not plated or clad with precious metal: |

| 7114 | ARTICLES OF GOLDSMITHS OR SILVERSMITHS WARES AND PARTS THEREOF, OF PRECIOUS METAL OR OF METAL CLAD WITH PRECIOUS METAL - Of precious metal, whether or not plated or clad with precious metal |

| 7118 | COIN |

Limited Purpose Trading Membership

A Qualified Jeweller with minimum net worth of INR 25 Crores based in India and not having a physical presence in IFSC, may apply for a Limited Purpose Trading Membership, wherein the entity can only trade on its own account (proprietary trading). No client on boarding shall be permitted for such a trading member.

- All compliance to be handled by the LPTM

- LPTM has to pay charges and open account with Depository and Clearing member

- Trading to be done by self and no other client onboarding

- Dedicated resource is required

- LPTM Membership costs around 4500 USD per year

IIBX Products

IIBX aims to cater Gold refineries, Institutional Investors, Bullion Dealers, Banks and Exporters

GOLD 995

- Trading Unit 1kg= (31.99 troy ounce)

- Price Quote U.S. dollars and cents per troy ounce

- Maximum order size= 10kg

- Tick size (Minimum Price Movement)= US $0.10

- Margin= 100% (T+0) or Volatility Based Margin, Extreme Loss Margin, Mark to Market Margin (T+2)

GOLD MINI 999

- Trading Unit 100 gram= (3.21 troy ounce)

- Price Quote U.S. dollars and cents per troy ounce

- Maximum order size= 10kg

- Tick size (Minimum Price Movement)= US $0.10

- Margin= 100% (T+0) or Volatility Based Margin, Extreme Loss Margin, Mark to Market Margin (T+2)

SILVER

- Trading Unit 30kg= (964.500 troy ounce)

- Price Quote U.S. dollars and cents per troy ounce

- Maximum order size= 600kg

- Tick size (Minimum Price Movement)= US $0.01

- Margin= 100% (T+0) or Volatility Based Margin, Extreme Loss Margin, Mark to Market Margin (T+2)

Delivery and Settlement:

The Trading & settlement Schedule Would be as Follows: -

| Present Timing | Updated Timing | |

|---|---|---|

| Trading Hour | 09:00 hrs to 15:30 / 16:30 hrs (Depending on day light saving) IST |

No Change |

| Settlement Time | 18:00 hrs to 21:30 hrs (IST) Same Day | 18:00 hrs to 21:30 hrs (IST) Same Day |

| Processing of Obligation | 17:30 hrs | No Changes |

| Confirmation of pay-in of fund and securities | 18:00 hrs | No Changes |

| Close out | 19:00 hrs | No Changes |

| Interbank Swift Transfer Instruction | 20:00 hrs | 19:30 hrs |

| Pay out of funds and BDR | 21:00 hrs | 20:00 hrs |

Settlement Price

The settlement price shall be the closing price of the bullion contract on the trading day.

Closing price shall be volume weighted average price of the last 30 minutes subject to minimum of 10 trades.

In case of less than 10 trades in the last 30 minutes trading, volume weighted average price of the last 10 trades.

In absence of last 10 trades, volume weighted average price of the last 5 trades.

In absence of last 5 trades, last traded price of the day.

In absence of last traded price of the day, previous days close price taken for the computation.

Process flow for IIBX Gold Imports

STEP 1

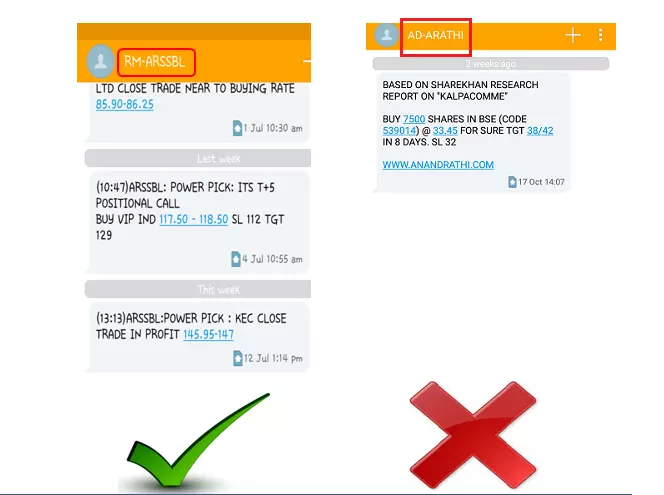

Open a trading account with Anand Rathi International Ventures ( IFSC ) Pvt Ltd

STEP 2

Open a Demat account with IIDL ( India International Depository Limited )

STEP 3

Remittance from your bank

STEP 4

Trade on IIBX Platform

NRI Entities can Buy and Sell the Gold but Qualified Jewellers can only Buy and Import the gold to domestic area.

Key Benefits and Value for Bullion dealers and Jewellers

- Lower transaction cost & Longer trading hours

- Price Discovery

- Digitally- enabled, best in class customer experience.

- Quality assurance, Reliability and Operational excellence with International standards.

- No tax for 10 years out of any 15 years.

IIBX - FAQs

For more information email your queries to giftifsc@rathi.com

For subscribing our IIBX Reports and News Update

For More Information

Dinesh Modi – Sales Head

ARIVPL – GIFT city office

9987231156

Dubai Office Representative

Sujith Variiath

+971 52 1489007

Note:

Note: