Call Back

NSE IFSC Receipts:

Investment in US Stocks

Trading in Global Stocks* is an innovative first-of-its-kind product, offered by NSE IFSC, giving Indian Retail Investors to diversify their investment in global economies and top performing companies. All investments are subject to RBI’s Liberalised Remittance Scheme.

Key Features

• Trading, Clearing, Settlement of Global stocks* governed and regulated by IFSC Authority.

• Trading in fractional quantity and demat holdings with IFSC depository.

• Eligible to receive corporate action benefits.

• All orders will be traded and settled in NSE IFSC; No order will be diverted to other platform or brokers registered with global exchanges.

• Low cost remittance through preferred Banking partners

• Presently 50 US Stocks in the form of unsponsored depository receipts (UDR) are available for investment.

Eligible Trading Members

a) Person resident outside India

b) Non-resident Indians

c) Individual resident in India who is eligible under FEMA to invest funds offshore, to the extent allowed in the Liberalized Remittance Scheme of Reserve Bank of India

Stepwise Process

An Indian resident who wishes to trade in NSE IFSC Receipts on NSE IFSC platform must complete the below formalities before he can commence trading:

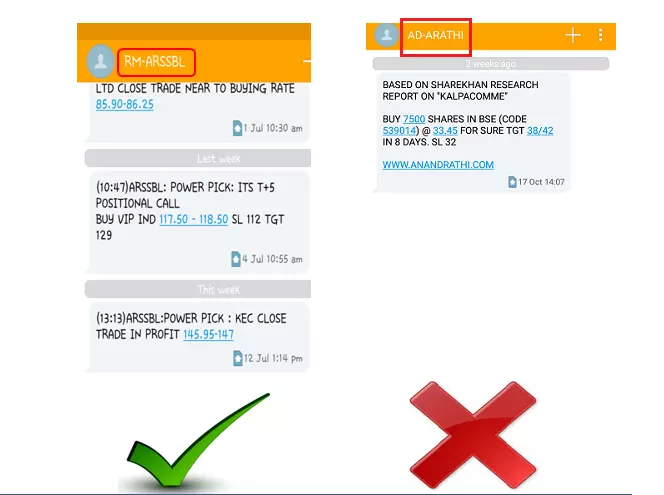

Register with an IFSCA registered Trading Member – Anand Rathi International Ventures (IFSC) Pvt Limited and complete the KYC requirements

Complete documentation for Liberalized Remittance Scheme (LRS) with the bank

Transfer US Dollars from your bank account to the your trading account with Anand Rathi International Ventures ( IFSC ) in GIFT City

On Confirmation and Receipt of the USD funds start trading NSE IFSC Receipts on NSE IFSC platform.

*All documents including nominee proof to be self attested by the account holder

Documentation

Non Resident Indian

| Document | Mandatory or Optional |

|---|---|

| PAN | Mandatory |

| 3 month Bank Statement ( Funding Bank ) or ITR or Cancelled Cheque | Mandatory |

| Overseas Address Proof - Utility Bill | Mandatory |

| Aadhar Card & Aadhar Consent Letter | Optional |

| Passport with valid VISA Stamp | Mandatory |

| Passport Size Photo | Mandatory |

Indian Domestic Customer- Individual

| Document | Mandatory or Optional |

|---|---|

| PAN | Mandatory |

| 1 month Bank Statement ( Funding Bank ) or ITR | Mandatory |

| Local Address Proof - Utility Bills | Mandatory |

| Aadhar Card & Aadhar Consent Letter | Mandatory |

| Cancelled Cheque | Optional |

| Passport Size Photo | Mandatory |

Eligible Foreign Investor

| Document | Mandatory or Optional |

|---|---|

| PAN | Mandatory |

| Tax Identity Number or Equivalent ID | Mandatory |

| Valid Passport ( Foreign) / OIC Card | Mandatory |

| 3 Months Overseas Bank Statement | Mandatory |

| Overseas Address Proof | Mandatory |

| Passport Size Photo | Mandatory |

Indian Resident having Account with Anand Rathi

| Document | Mandatory or Optional |

|---|---|

| KYC Consent Form | Mandatory |

| 1 month Bank Statement ( Funding Bank ) or Cancelled Cheque | Mandatory |

Courier the duly filled form and KYC documents to:

|

Dinesh Modi 634, SIGNATURE TOWER, 6TH FLOOR, BLOCK 13B, ZONE 1, GIFT CITY, GANDHINAGAR, GUJARAT, INDIA - 382355 |

* All documents including nominee proof to be self attested by the account holder

* All KYC Documents to be self Attested

Note:

Note: