COMPANY SNAPSHOT

- BSE Code: 500696

- |

- NSE Symbol: HINDUNILVR

- |

- ISIN: INE030A01027

15.85

(0.58%)

15.85

(0.58%)

-

Open (Rs)2737.90

-

Close (Rs)2722.05

-

High (Rs)2737.90

-

Low (Rs)2737.90

-

Face Value1

-

Market Capital (Cr.)643294.52

-

Daily Volume5212

-

Life Time High2859.30

-

Life Time Low220.70

-

52 Week High2811.30

-

52 Week Low2172.05

| STOCK | IND.AVG. | RELATIVE TO IND. | |

|---|---|---|---|

| Price/Earning TTM | 61.9425 | 31.7100 | |

| Price/Book | 10.4600 | 4.0900 | |

| Price/Sales TTM | 9.2500 | 3.0200 | |

| Rev Growth (3 yrs Avg.) | 2.2400 | 22.1400 | |

| EPS Growth (3 yrs Avg.) | 1.5300 | 36.3500 | |

| ROE TTM | 19.9900 | 11.9300 | |

| Debt/Equity | 0.0000 | 1.1600 | |

| ROC TTM | 27.6200 | 14.2900 | |

| Dividend Yield | 1.8500 | 0.3800 | |

| PBIDTM % | 25.00 | -70.31 | |

| PBTM % | 22.51 | -446.15 | |

| PATM % | 16.62 | -448.36 |

Corporate Action 3Yrs

Event Calender

Compare This Stock With

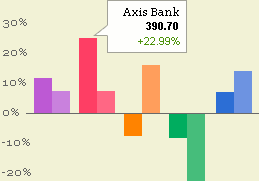

| Stock | LTP(CHG%) | Intraday |

|---|---|---|

| Glaxo.C .. | 10732.60 (4.85) |  |

| Hatsun .. | 1307.95 (2.12) |  |

| Jyothy .. | 550.00 (1.68) |  |

| Bikaji .. | 844.00 (1.04) |  |

| LT Food .. | 315.65 (0.81) |  |

Note:

Note: