Open Demat Account

Whatever your investing style, we have a solution for you!

For First Year

Opening Charges

Customers

Get Your Free* Demat Account in 4 Easy Steps

Setting up a Demat account in India is fast and easy with Anand Rathi. Follow these four simple steps to open a Demat account online and start investing:

Benefits of Opening a Demat Account with Anand Rathi

Opening a Demat account with Anand Rathi is the first step to a fulfilling financial relationship. Besides access to the vibrant Indian stock market, you gain a trusted investment partner with data, tools, and support tailored to your financial needs.

Here’s what makes Anand Rathi’s low brokerage Demat account an excellent one-stop solution for investors in India:

Comprehensive Investment Options

Access multiple investment products, including equities, mutual funds, debt funds, derivatives and many more, from a single account.

Research and Advisory Services

Benefit from our research-backed recommendations and insight to identify and invest in great market opportunities.

Dedicated Customer Support

Depend on our expert team for all aspects of your account, from setup to investment guidance.

Competitive Fees

Enjoy the advantage of opening a Free* Demat account and enjoy zero Account Maintenance Charge* (AMC) for your first year.

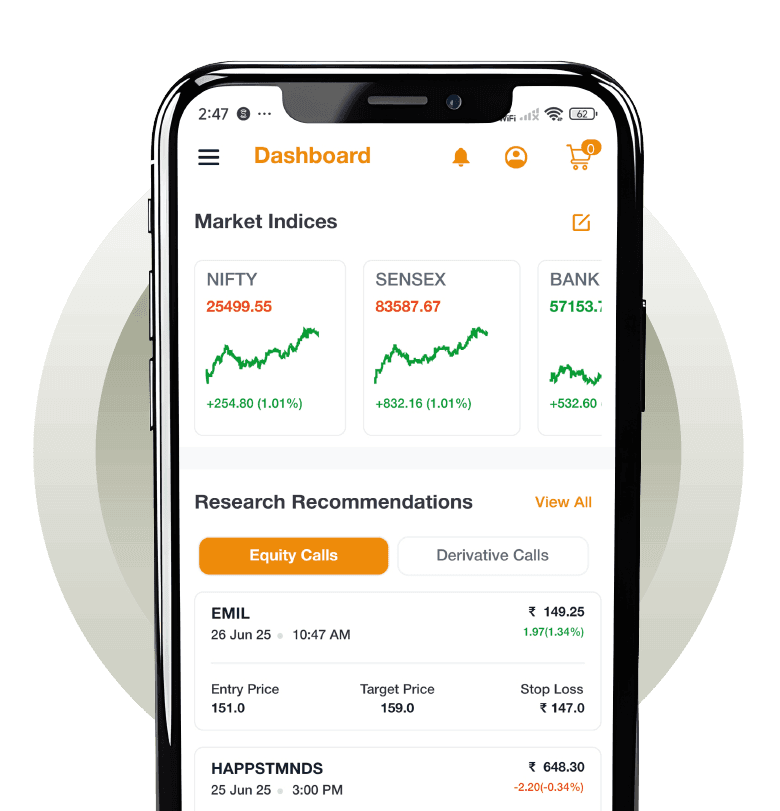

User-Friendly Digital Platforms

Manage and monitor your investments at home and on the go with our secure, intuitive mobile and web platforms.

One Account, Many Opportunities Tailored for Every Investor

A single Demat account opens up a universe of investment and trading opportunities. Here are some of the key benefits you can enjoy:

Diverse Investments

Invest, hold, and manage multiple asset types in one place.

Effortless Portfolio Tracking

Access and monitor your portfolio from your desktop or mobile.

Streamlined Trading

Buy and sell shares online and maximize short-term opportunities.

No Physical Risks

Gain peace of mind against theft and loss of securities.

Corporate Benefits

Receive dividends, bonus issues, and other corporate benefits directly to your account

Documents Checklist to Open a Demat Account in India

Here is a quick checklist of essential documents to open an online demat account in India. Keep them prepared before starting the Demat account opening process online to ensure a quick start to your investing journey.

Eligibility for Demat Account Opening in India

Demat accounts are designed to accommodate diverse investor profiles and are accessible to all individuals. Here’s who can open a Demat account in India:

Types of Demat Accounts

Investors in India have access to multiple types of demat, that are designed for different investment needs and regulatory requirements:

1.

Regular Demat Account

2.

Repatriable Demat Account

3.

Non-Repatriable Demat Account

4.

Basic Services Demat Account (BSDA)

Demat Account FAQs

Your Questions, Answered

Demat Account can seem complex, but we’ve got you covered. Our comprehensive FAQ section answers common questions like:

What is a Demat Account?

What documents are needed to open a Demat account?

Who can open a Demat account?

Can I have more than one Demat account?

What are the charges for opening a Demat account?

Can an NRI open a Demat account?

Is a Demat account required for SIP investments?

Can I transfer shares from one Demat account to another?

How long does it take to open a Demat account?

Is a Demat account safe?

What is the DP Name in a Demat account?

The DP (Depository Participant) Name is the name of the financial institution or brokerage (such as Anand Rathi) where your Demat account is held. The DP acts as the intermediary between you and the central depository (like NSDL or CDSL), enabling you to hold and trade securities electronically.

How can I find my Demat account number?

Your Demat account number is a unique 16-digit identifier linked to your account. It can usually be found on your account statements or by logging into your trading platform. The first eight digits usually represent the DP ID, while the last eight are specific to your account.

Can I withdraw money from a Demat account?

Do I need separate Demat accounts for trading in equities and mutual funds?

"No, a single Demat account allows you to hold a variety of securities, including equities, mutual funds, bonds, and ETFs. This all-in-one approach simplifies tracking and management.

Can I open a Demat account without a PAN card?

"A PAN card is mandatory for opening a Demat account in India, as it’s required for tax purposes and identity verification. Without a PAN, your application cannot be processed.

How often do I need to update my KYC for a Demat account?

Updating your KYC (Know Your Customer) information is generally required only if there are changes in your personal details, such as address or contact information. Routine KYC checks may occur as part of regulatory compliance.

Can I convert my physical share certificates to Demat form?

Yes, physical share certificates can be converted to electronic form through a process called Dematerialization. Submit a Dematerialization Request Form (DRF) along with your physical certificates to your DP for a seamless conversion.