TradeXpress

Your Gateway to Seamless Trading

Access powerful tools and features to simplify your trading journey.

Why Choose TradeXpress?

Trade Smarter, Faster, and Better

A platform designed to empower every trader with speed, accuracy, and control.

User-Friendly Interface

Intuitive design for hassle-free navigation.

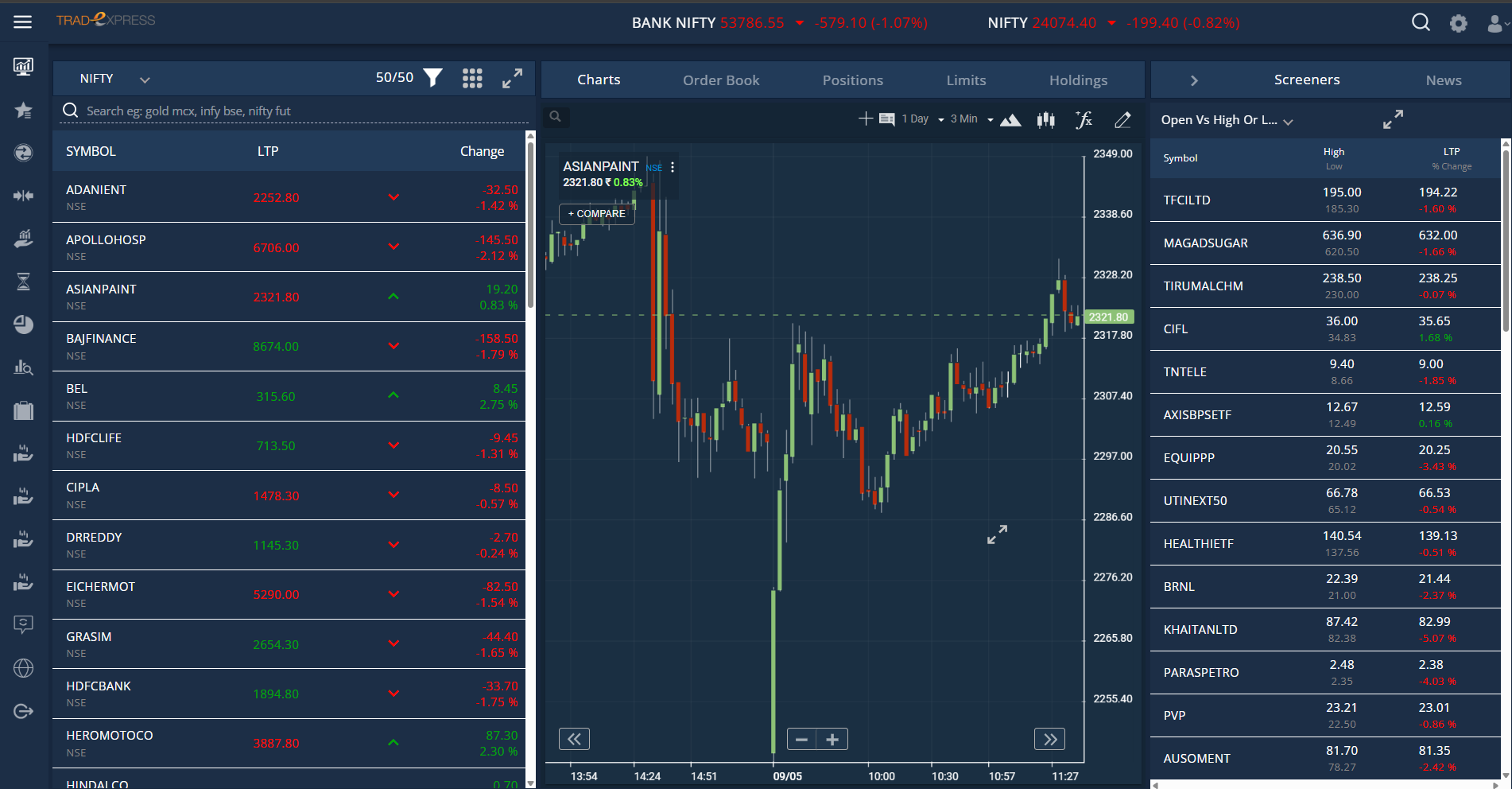

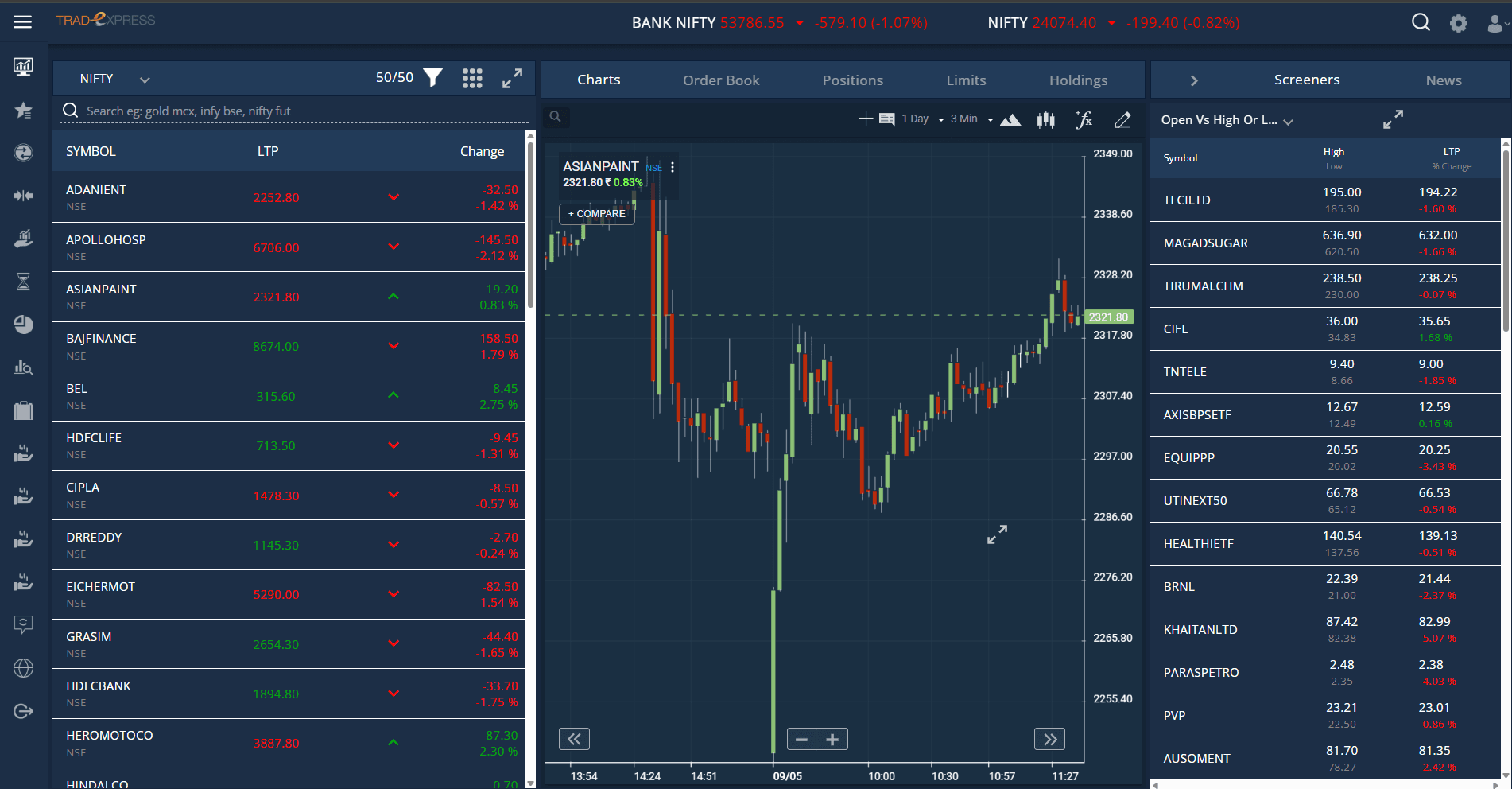

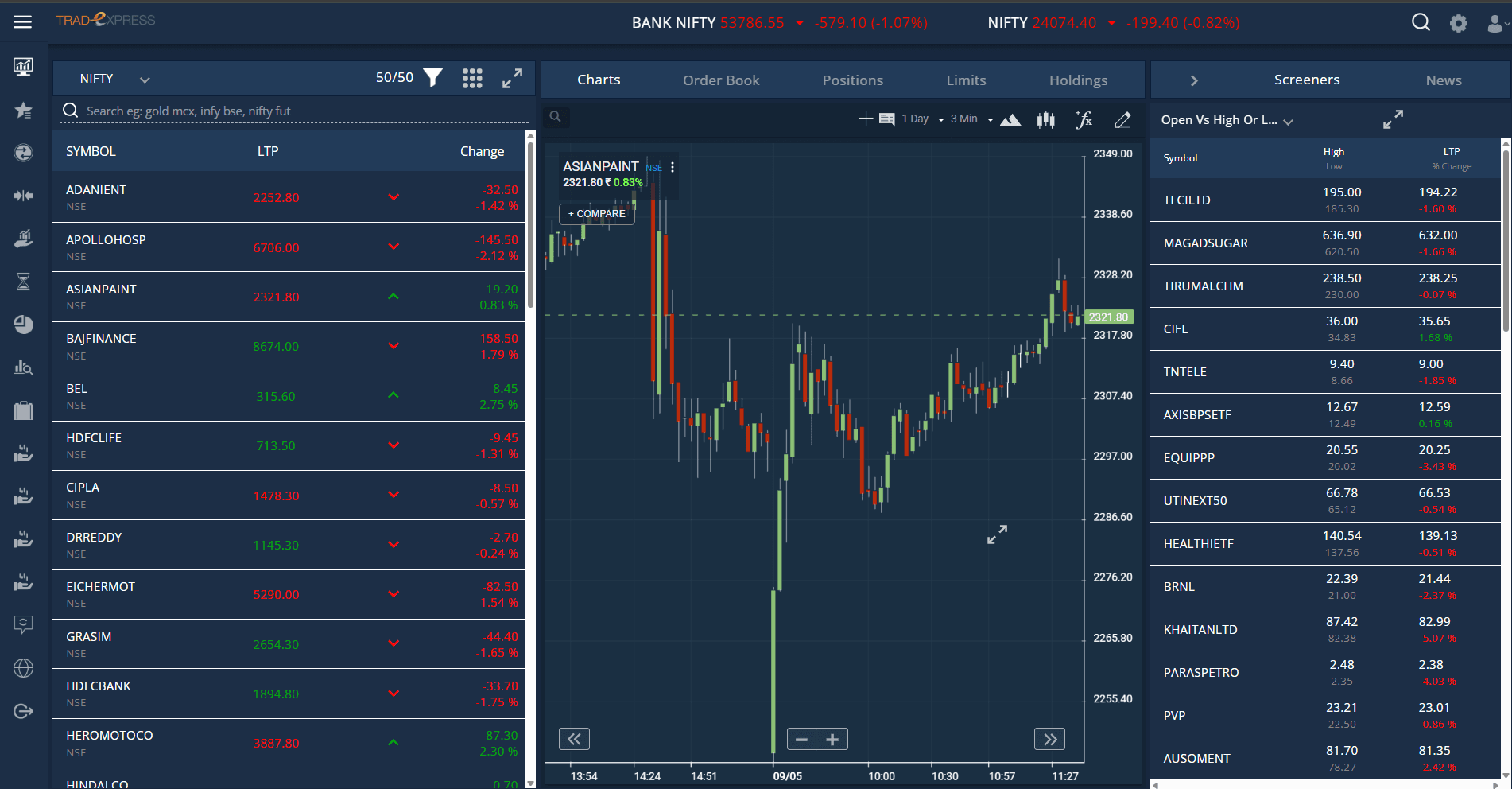

Comprehensive Dashboard

Get a 360-degree view of markets, holdings, orders, and more.

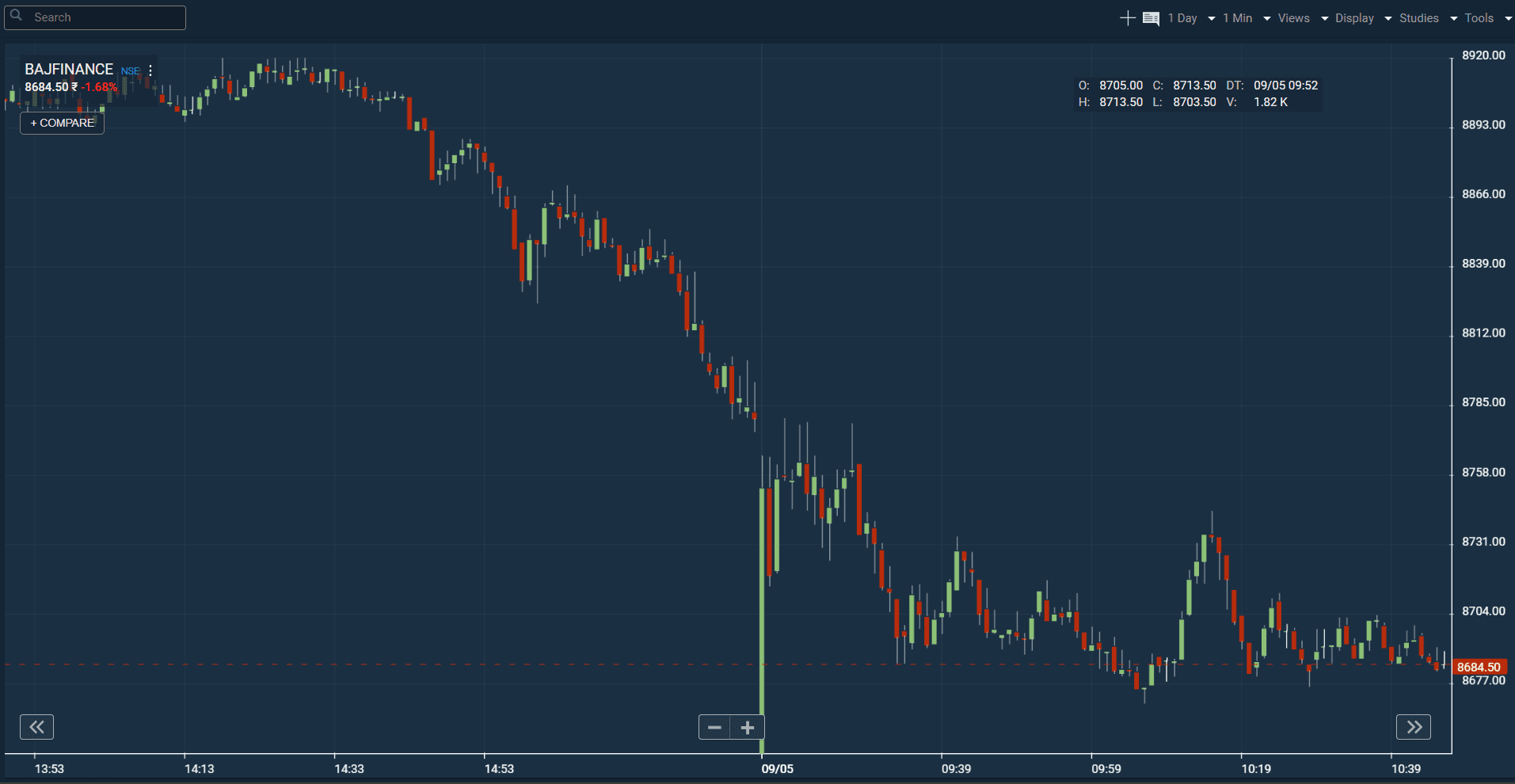

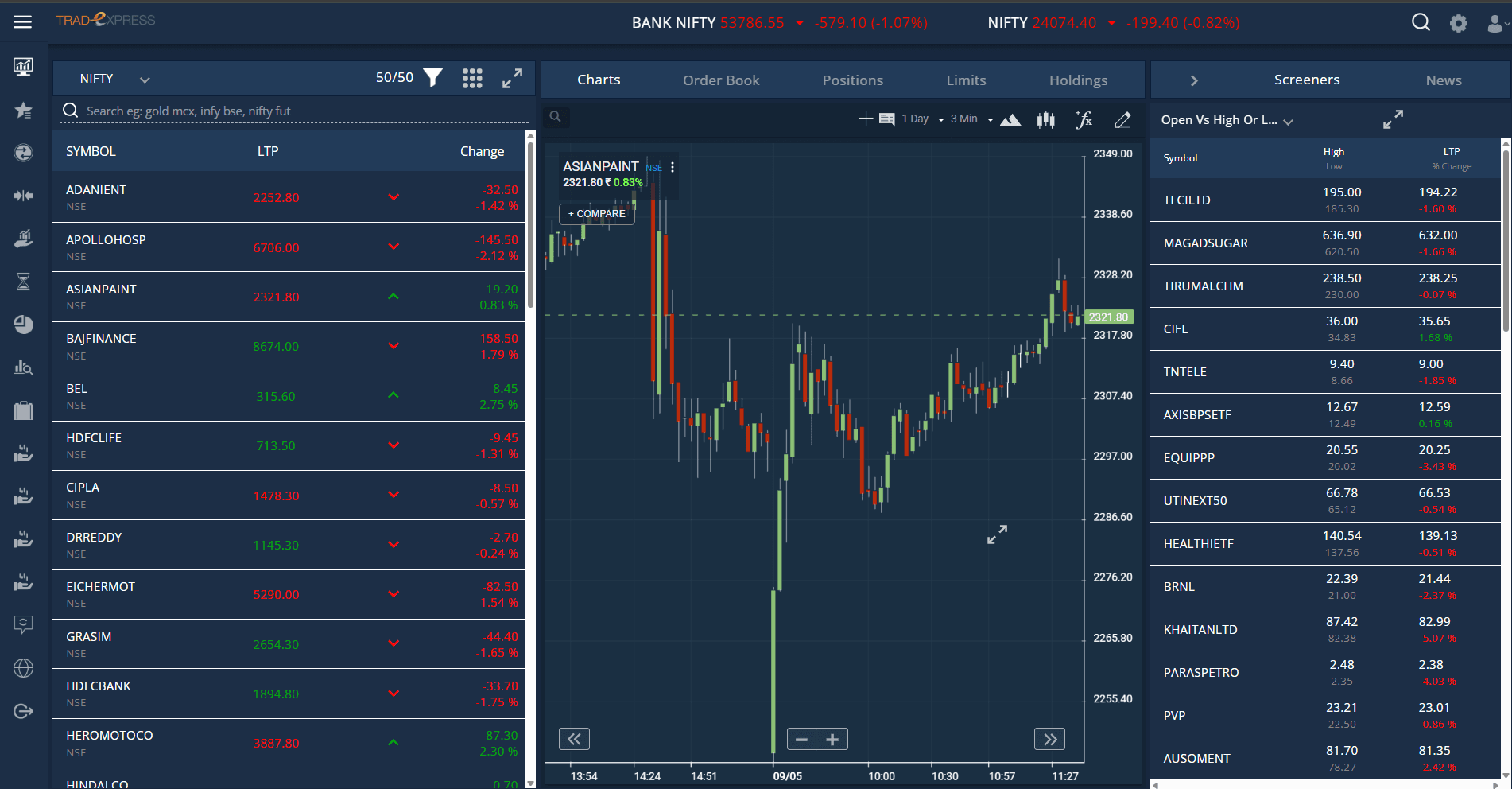

Advanced Charting Tools

Access customizable charts with multiple timeframes, intervals, and chart types.

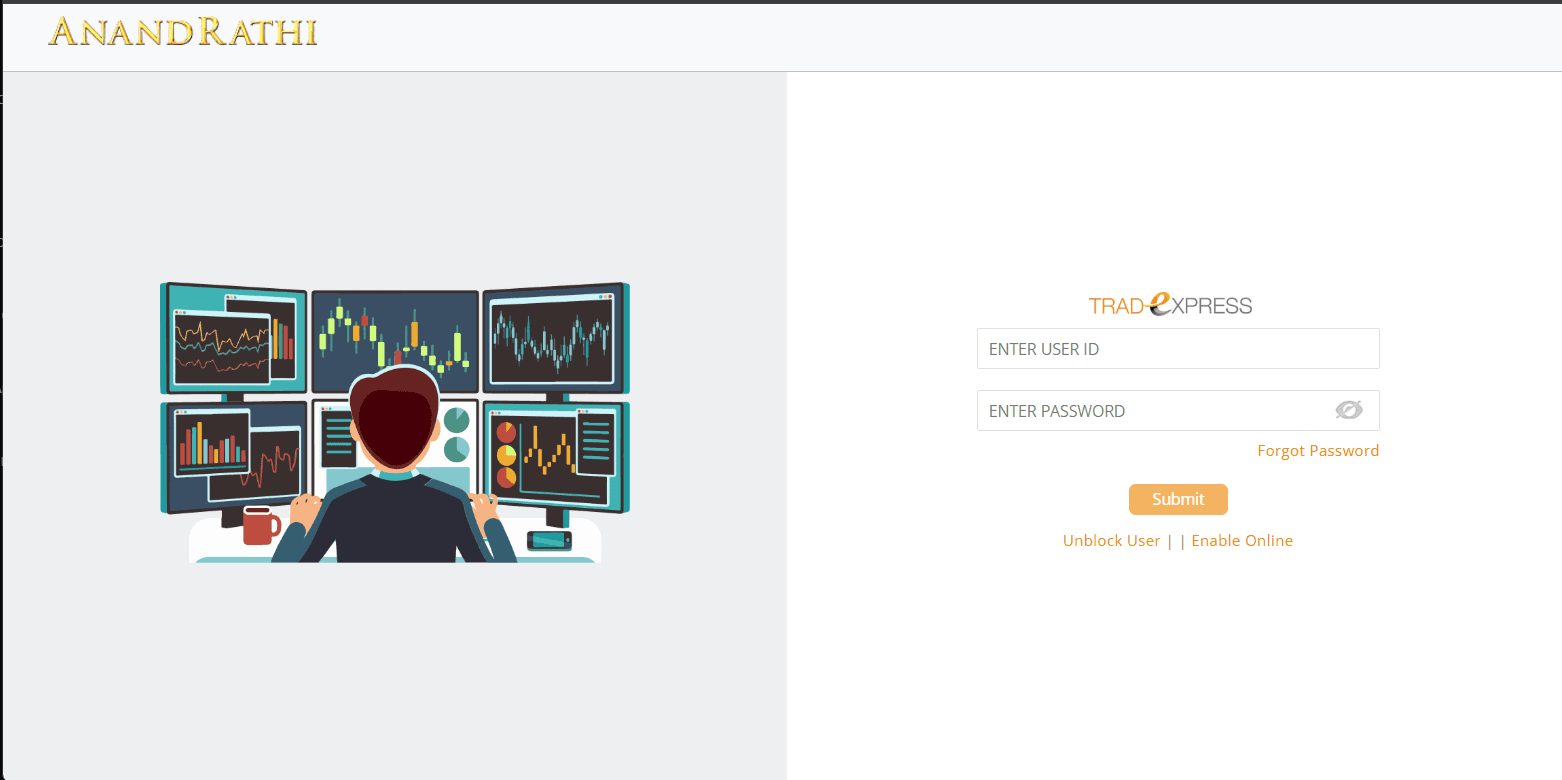

Quick Login Options

Easy access with robust security features like OTP-based authentication.

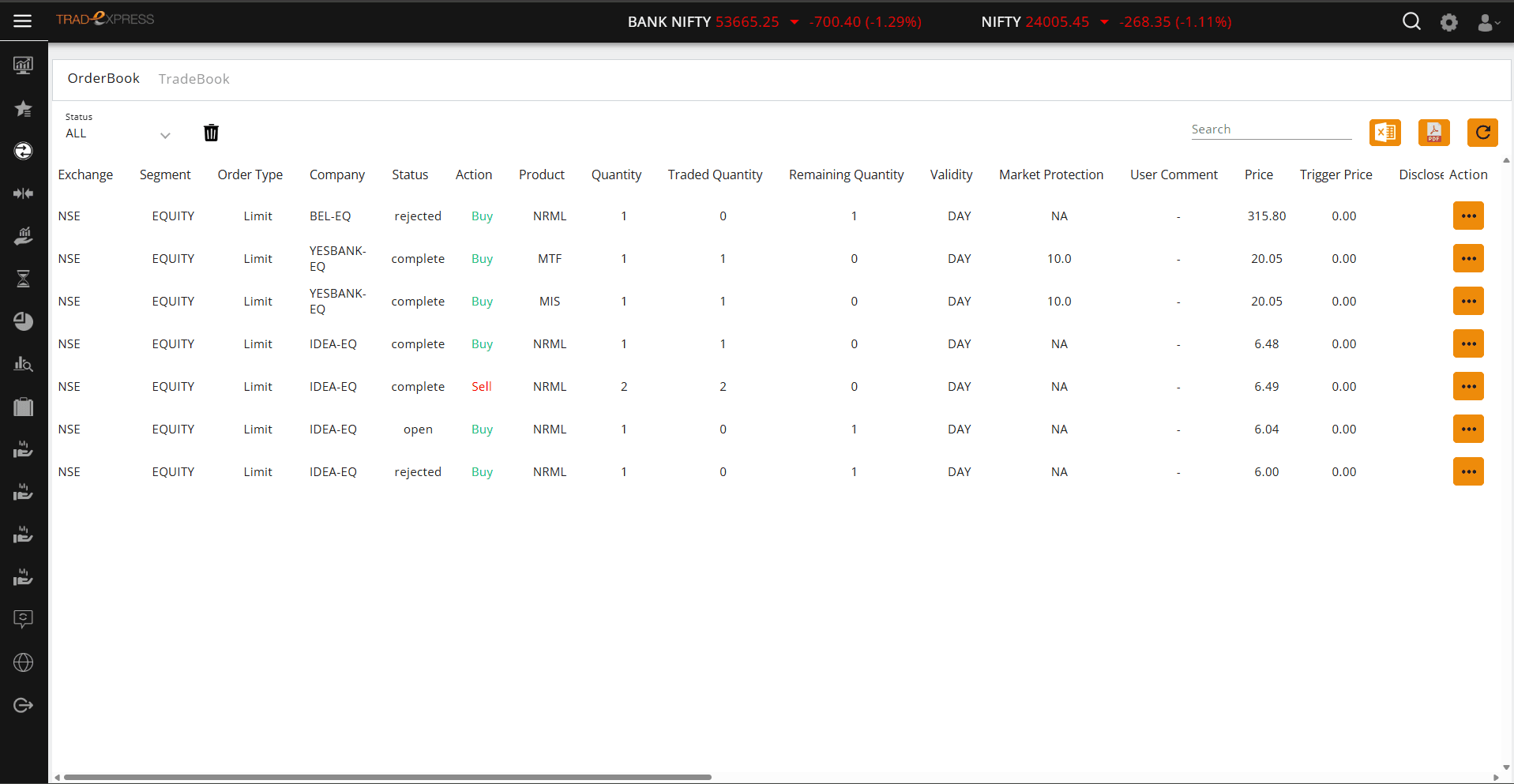

Order Execution Options

Place orders with flexibility across Normal Margin, Margin Intraday Square-off, Bracket Order, Cover Order, or Margin Trading Facility.

Real-Time Analytics

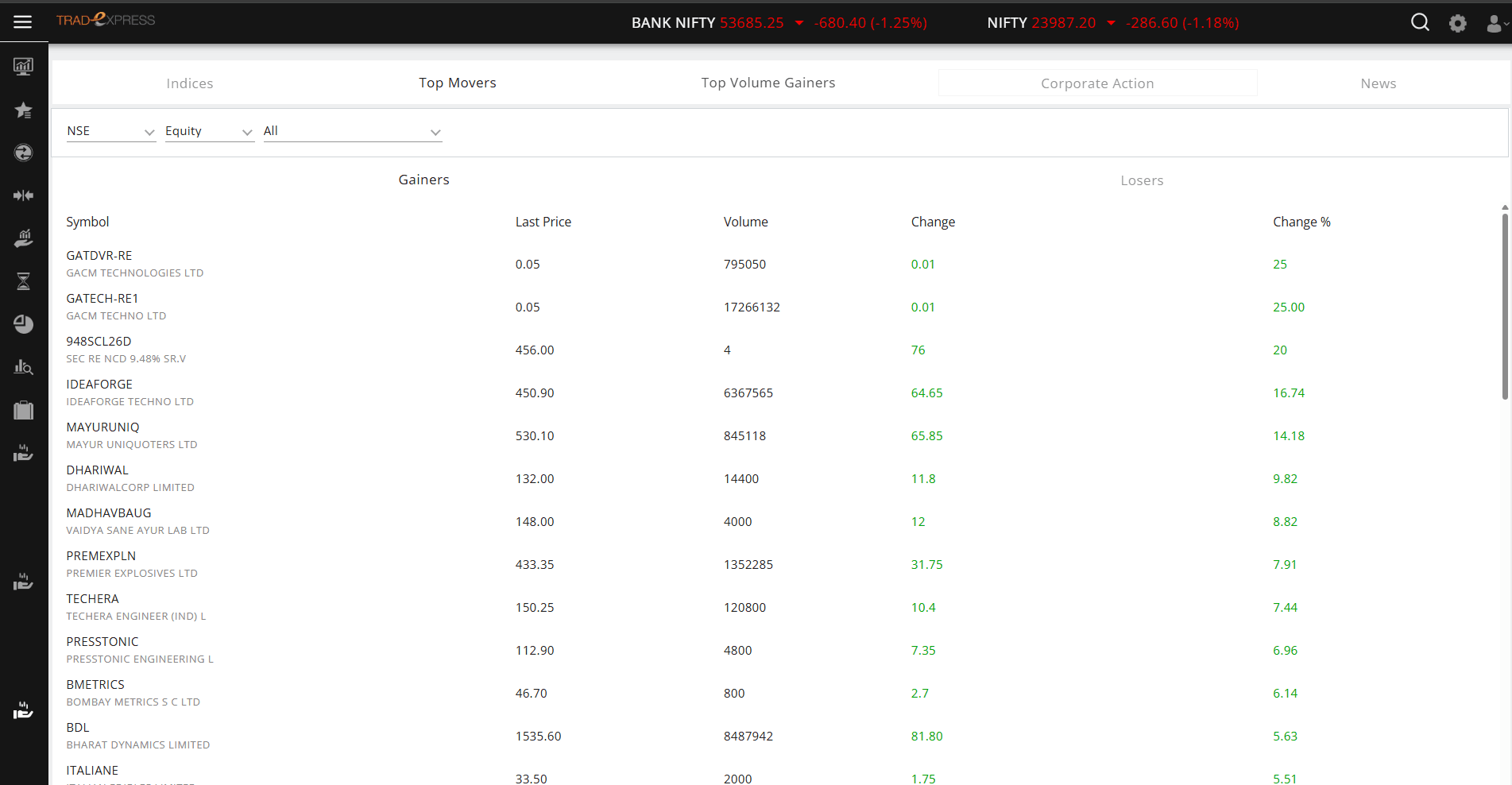

Gain insights from screeners, strategies, and market movers.

Market Updates

Access indices, top movers, volume gainers, corporate actions, and news in one place.

Light/Dark Theme

Customize your interface with light or dark mode options.

User-Friendly Interface

Intuitive design for hassle-free navigation.

Key Features of TradeXpress

Experience Trading Like Never Before

Packed with features to make your trading experience seamless and powerful.

Holistic Dashboard

View all critical information at a glance:

Advanced Charting Tools

Powerful technical analysis at your fingertips

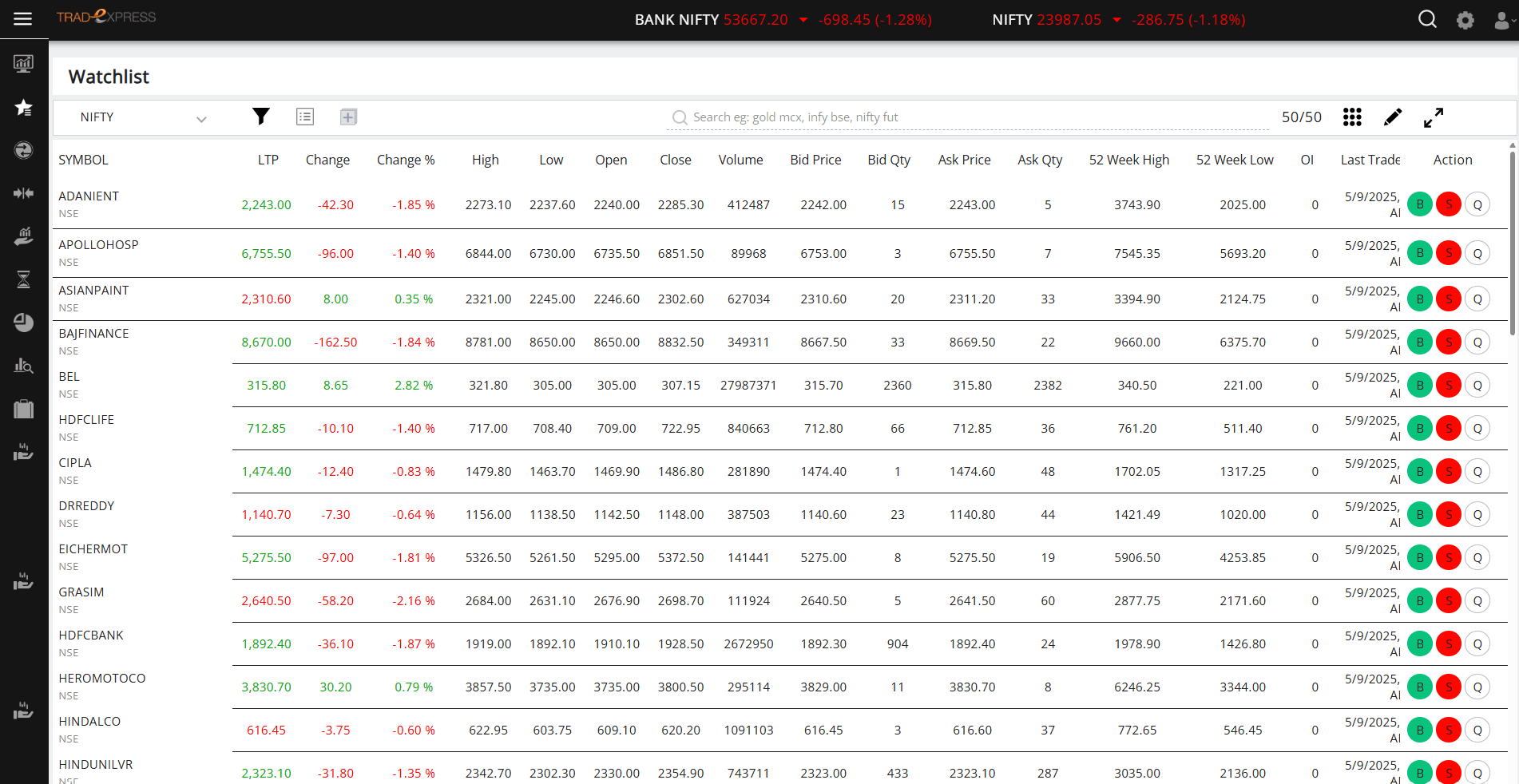

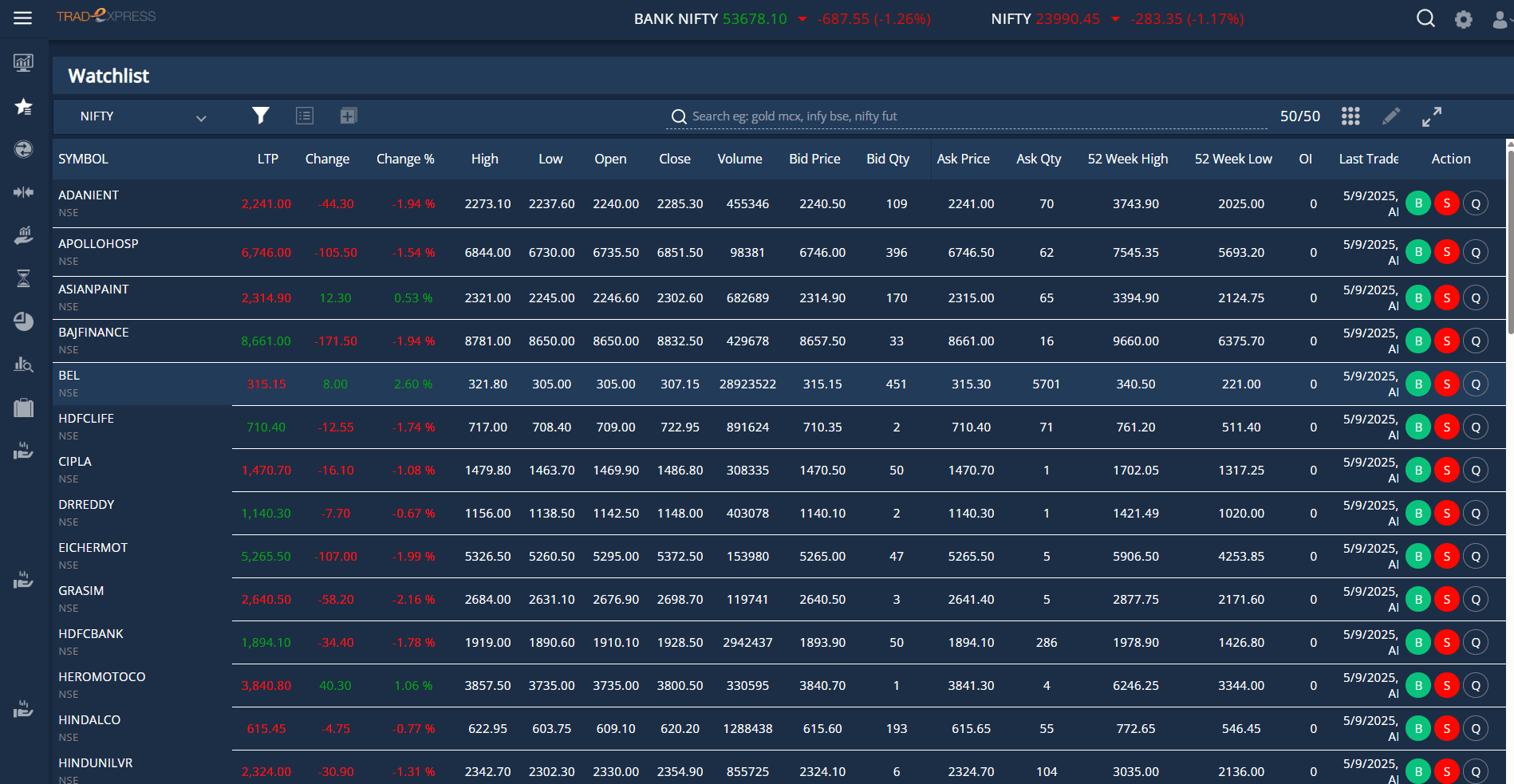

Watchlists

Organize and track your favorite securities

Quotes and Insights

In-depth market data at a glance

Seamless Order Placement

Execute trades efficiently with multiple options

Portfolio Insights

Comprehensive view of your investments

Fund Management

Seamless financial operations

Analytics & Screeners

Powerful tools to identify trading opportunities

Wealth Basket

Simplified portfolio diversification

Start Trading in 3 Easy Steps

Begin your trading journey with Anand Rathi's seamless Trade Express platform designed for both new and experienced traders.

Login

Secure login with client code and OTP validation.

Explore

Use the intuitive dashboard to analyze markets and plan trades.

Trade

Execute orders across various product types with ease.

Access TradeXpress Instantly!

Simplify Your Trading Journey with TradeXpress

Fast, intuitive, and feature-packed.

Trading Platform FAQs

Your Questions, Answered

Stock trading platforms can seem confusing, but here are answers to the most important questions investors ask.

Why Choose AR TradeXpress?

Backed by years of trusted brokerage experience and powered by next-gen tools, AR TradeXpress is what your desktop trades deserve.

- User-Friendly Interface: Access to an intuitive design for hassle-free navigation.

- Comprehensive Dashboard: Get a 360-degree view of markets, holdings, orders, and more.

- Advanced Charting Tools: Access customizable charts with multiple timeframes, intervals, and chart types.

- Quick Login Options: Easy access with robust security features like OTP-based authentication.

- Order Execution Options: Trading from a beach? Ensure you have a stable Wi-Fi connection, and AR TradeXpress will take care of the rest. Place orders with flexibility across Normal Margin, Margin Intraday Square-off, Bracket Order, Cover Order, or Margin Trading Facility.

- Real-Time Analytics: Gain insights from screeners, strategies, and market movers.

- Market Updates: Access indices, top movers, volume gainers, corporate actions, and news in one place.

- Light/Dark Theme: Customize your interface with light or dark mode options.

What Is A Trading Platform?

A trading platform is your digital space to buy, sell, and manage investments in stocks, ETFs, derivatives, commodities, and more — all from your laptop or phone.

With these online trading platforms, you can track live prices, execute trades in seconds, and monitor your portfolio - anytime, anywhere.

Whether you're making your first investment or an active trader, a good trading platform makes it simple, secure, and accessible.

Factors To Consider Before Registering On A Trading Platform

Before registering on any online trading platform in India, clarify these questions:

- Is the platform SEBI-registered and compliant with regulatory guidelines?

- Does it offer fast order execution with minimal downtime?

- Are brokerage charges clearly listed?

- How easy is it to navigate the platform's dashboard?

- What products are allowed to trade on their trading platform?

- What security measures are available for your account?

- Is customer support quick and responsive during market hours?

What Are Some Advantages Of A Trading Platform?

With these online trading platforms, you can:

- Invest/Trade Anytime, Anywhere: Whether you're at home, between meetings, or halfway across the world, the market is always just a tap away. Trade on your schedule with ease on the mobile or desktop app.

- Lower Costs: Say goodbye to unnecessary mediators. With reduced brokerage and transparent pricing, more of your money works for you instead of going into fees.

- Full Transparency: SNo more guessing where your investments stand. See your orders, holdings, and profit/loss in real time, so you always know exactly how you're doing with better insights.

- Better Decision-Making: Trade smarter with in-built tools like live charts, market news, and analytics. You'll always have the information you need before hitting that "Buy" or "Sell" button.

- Effortless Portfolio Management: Trade smarter with in-built tools like live charts, market news, and analytics. You'll always have the information you need before hitting that "Buy" or "Sell" button.

How Does A Trading Platform Work?

The process is simpler than you think. Here’s how it works:

- Account Setup: Open your Demat and trading account through a quick online KYC process. Also, don't forget to link it to your bank account.

- Add Funds: Transfer money securely from your bank account to your trading wallet.

- Market Access: Browse live prices, charts, and stock details directly on the platform.

- Place Orders: Choose the stock or instrument, set your order type, and confirm the trade.

- Real-Time Tracking: Monitor your orders, positions, and portfolio instantly.

- Withdraw Funds: Sell your holdings anytime and transfer profits back to your bank.

How To Choose A Trading Platform In India?

Before committing to or registering on any trading platform in India, look for:

- SEBI-Registered & Regulated Platform: Always choose a trading platform that SEBI regulates to ensure your trades and funds are handled with the highest safety standards.

- Clean Interface & Dashboard Tools: Pick a platform with an intuitive design, easy navigation, and powerful trading tools such as charts, scanners, and watchlists.

- User Reviews & Ratings: Browse through recent reviews on the Play Store or App Store to spot potential red flags like slow order execution, downtime, or login issues.

- Digital Onboarding: Choose platforms that enable you to complete KYC and account activation fully online, allowing you to start immediately without any delays.

- Transparent Brokerage & Charges: For a quick comparison, check the platform's brokerage fees, transaction charges, and any hidden costs.

- Strong Security Features: Ensure the platform uses encryption methods, two- factor authentication (2FA), and secure payment gateways to protect both your funds and data.

- Wide Range of Tradable Instruments: Look for platforms that let you trade multiple asset classes (like equities, derivatives, commodities, and currencies), all in one place.

- Responsive Customer Support: Choose a platform with real-time support via call, chat, or email, especially during market hours – so you're never left waiting when every second in the market counts.

Are trading platforms regulated?

Yes. In India, trading platforms must be registered with the Securities and Exchange Board of India (SEBI) and operate through a licensed broker, ensuring investor safety and compliance with market rules.

Can I trade on a trading platform using my mobile phone?

But, if you wish to access AR TradeXpress, it is possible via desktop. Click on the login button, Enter your unique User ID and Password to use this online trading platform.

Can NRIs trade on Indian trading platforms?

Definitely, NRIs can trade on Indian exchanges through NRE/NRO accounts and a Portfolio Investment Scheme (PIS) account, provided the platform supports NRI trading. However, some AMCs may restrict investments from NRIs in the USA and Canada due to compliance rules.

How to get started with a trading platform?

Getting started is simple:

- Signing up on a SEBI-registered trading platform (mobile app or desktop terminal)

- Complete your online KYC

- Link your bank account

- Fund your trading account and start trading

What are some risks involved with a trading platform?

There are certain trading platform risks, such as market volatility, leverage risks, and execution delays. But it's also important to choose a secure and regulated platform to avoid fraud or technical glitches.

Can I use a trading platform for both long-term and short-term trades?

Yes. You can invest in company stocks for the long term or trade in intraday, derivatives, and commodities for short-term strategies—all in one platform.

How do I fund my trading account?

It is quite simple. Transfer funds via net banking, UPI, NEFT/RTGS, or integrated payment gateways to your wallet. Then, use them to invest or place orders. (Note: Before transferring, please ensure your trading account is linked to your bank account.)

Are there any taxes I need to consider when using a trading platform in India?

India, capital gains tax (STCG and LTCG) applies to profits from trades. Additionally, STT (Securities Transaction Tax), GST, and other exchange charges (like stamp duty) are deducted per transaction.

How can I secure my trading account?

To ensure the highest security, enable two-factor authentication (2FA), use a strong password, and log out after each session. Also, avoid accessing your account from public Wi-Fi, as it poses more risk to your account.

Can I trade globally with a domestic trading platform?

Some Indian brokers offer global market access via tie-ups with foreign brokers. Still, you'll need to check if your platform provides this feature.