Precious metal’s rush continues, as silver prices in India rise to an all-time high: Volatility to persist this week amid positive bias remains in white metal.

Reasons behind the record rally

Silver prices soared to $28.09 levels on Comex last week, fuelled by Fed rate cut prospects and geopolitical instability. Silver prices globally were at a 3-year high while trading at nearly $28 per oz. Silver prices in India are at an all-time high at nearly Rs. 82,000 per kg. Silver prices were up 11 per cent week on week, and 14 per cent month on month.

Middle East tensions and China’s heavy buying elevated silver’s demand, pushing prices up. Fed’s Powell hinted at cautious rate cuts, influencing silver’s long-term bullish outlook. The anticipation of a cut in interest rates by the US Federal Reserve was seen as one of the key factors that kept the silver price higher.

Federal Reserve Chair Jerome Powell, speaking at Stanford on April 3, 2024, expressed the need for more data before considering interest rate cuts, expected by markets in June. Despite job gains and inflation exceeding forecasts, Powell emphasized that rates would only drop if inflation consistently approached the Fed’s 2% target. This cautious approach, coupled with Fed officials like Raphael Bostic advocating for minimal rate cuts late in 2024, suggests a slower transition to lower rates.

Outlook

For Spot Silver, currently hovering below $28 per ounce, the current week scenario presents a volatile outlook amid a positive bias to persist in the medium-term perspective. While the delay in rate cuts may temper immediate gains as could be evidenced from the US CPI data due on Wednesday, the eventual easing of monetary policy could bolster Silver’s appeal as a hedge against currency devaluation and inflationary pressures, potentially driving prices higher in the medium term perspective of 2 – 3 weeks.

Overall we anticipate strong support for the prices to persist in the range of $ 26.65 – 26.15 – 25.77 for the week. The metal has reached the 161.8% Fibonacci extension level of its downtrend from 25.88 – 21.92 per ounce seen in Dec – Feb month, hinting at potential further gains. If silver breaks above $28.10, it could reach the 261.8% Fibonacci level, aiming for higher targets at $28.64 and $29.25. Conversely, a drop below $27.20 might lead to a downward trend.

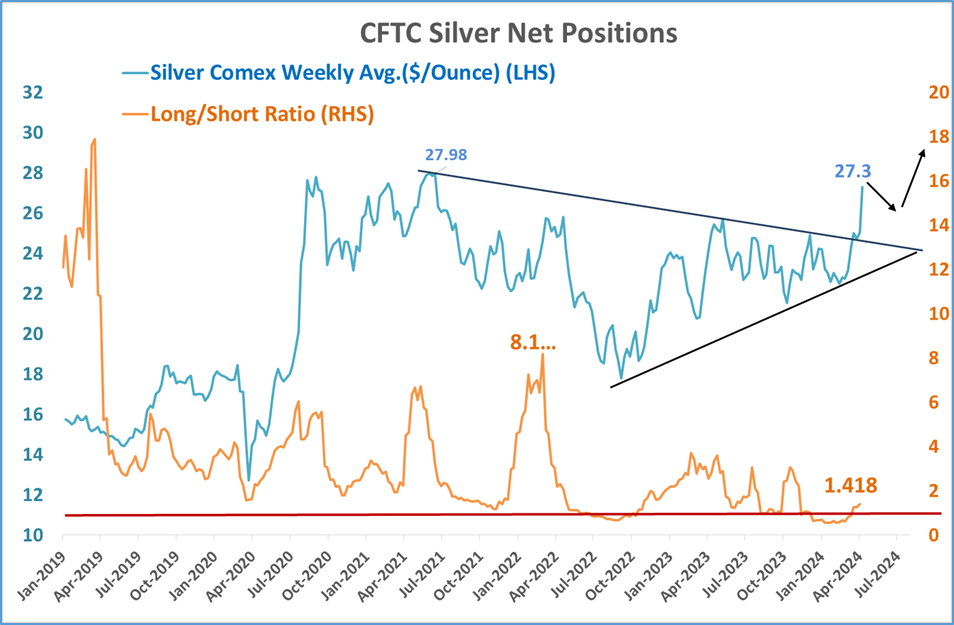

Meanwhile, with the Silver Weekly Average price on Comex at the highest level since June’21, the current Long/Short ratio of 1.418 on Comex is way below its high of 8.180 hit in March’22 as shown in the Chart above. This indicates that prices still have much more upside left in the medium to long-term perspective. of 3 – 4 months as 32 – 35 $ per ounce levels are still possible in the next 3-4 months perspective.