The Week gone by

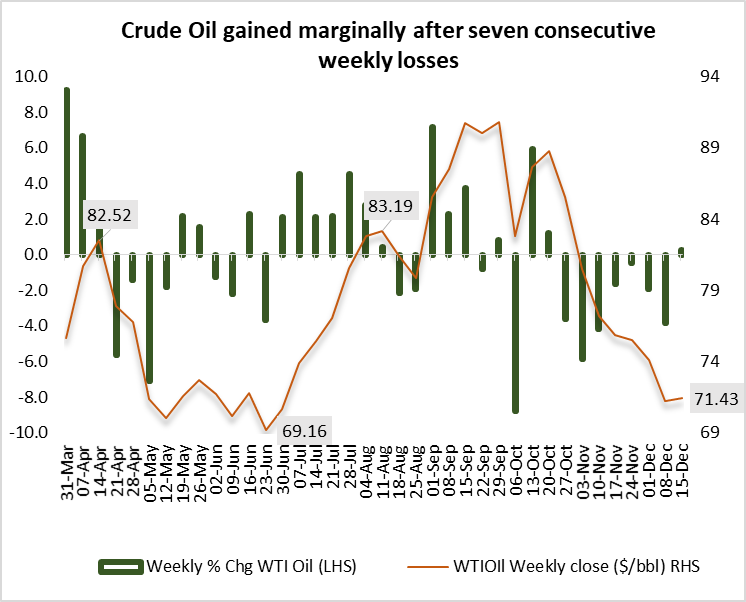

Crude oil witnessed a relief rally last week as Fed’s dovish guidance increased the appetite for riskier assets. The central bank last week signaled deeper-than-expected rate cuts in 2024 providing cushion to the US economy against possible slowdown. Bigger cuts next year may lead to a soft landing of the US recession and thus the impact on oil demand growth may be not as much as expected earlier. After seven consecutive weekly losses, the WTI oil rebounded from $67.71 per bbl level to close the week marginally higher at $71.43 level while the MCX Crude oil settled at Rs 5,952 per bbl.

Oil markets have been under a bear grip since the start of October as a surge in exports from non-OPEC countries and concerns over weakening demand exerted pressure on the prices, while market participants remain skeptical whether all OPEC members will adhere to the deeper voluntary cuts. Prices have slumped to the lowest level in last 5 months, declining about 24% from their September highs.

What’s happening this week?

The rebound rally in crude oil extended this week too with prices roaring towards $74 level on Monday before paring off gains as the Red Sea attack triggered supply disruption threat. Attacks by Yemen’s Iran-aligned Houthi militants on ships in the Red Sea are disrupting maritime trade. Freight firms reroute around the Cape of Good Hope to avoid the Suez Canal. About 8% of the world’s crude flows through the Suez Canal, putting pressure on tanker utilization if ships are forced to take the longer route around South Africa.

It is to be however, noted that the disruptions in the Red Sea are unlikely to have a large impact on crude oil prices because vessel re-direction opportunities imply that production won’t be directly affected. But prolonged re-routing of 7m b/d of gross oil flows (Source: Bloomberg), would boost spot crude prices relative to long-dated prices by $3-4/bbl because more oil on water would reduce the availability of global commercial inventories.

Outlook for the week ahead

With a few days to the end of the year 2023, we don’t see any sustainable up move in the prices, given the surplus oil balances. Crude oil is currently well supplied, and stockpiles have recovered from summer draws, thus offsetting the impact of a supply disruption. The Contango market structure for WTI oil continue to indicate weakness. Moreover, there are ample warning signs about the trajectory for demand. The International Energy Agency last week trimmed estimates for Q4 2023 and expect that growth will decelerate further next year. Rising production from the US, Brazil and Guyana is offsetting production OPEC+ cuts. Upside amid the ongoing Red sea attack will be short lived and markets will squarely focus on the OPEC+ additional voluntary cuts and whether they adhere to the same. The margin of error for the Saudi and their allies is very small and any weakness in demand or increase in supply or, worse, both could push the oil market into a surplus in Q1 2024.

Overall, from the short-term perspective, WTI oil may find strong support at $65-67 level while resistance zone is between 74-76 levels. For MCX Crude oil, major support is around Rs 5,400-5,550 while resistance zone is between Rs.6156-6350.