- The rupee depreciated by 8 paise to 82.84 against the US dollar in early trade on Friday, tracking a firm dollar against major rivals overseas weak sentiment in the domestic equity market and elevated level of crude prices nearing $87 per barrel also weighed on Rupee.

- The Reserve Bank of India in its bi-monthly monetary policy review decided to keep the key interest rate unchanged but hinted at tighter policy if food prices drive inflation higher.

- Later that day Rupee rebounded against the US dollar after the RBI asked banks to set aside a larger part of incremental deposits under the cash reserve ratio (CRR) as part of measures to take out excess liquidity from the banking system.

- Rupee remains pressured, but not enough for the current range to be in danger yet. To top it all, fears about the Chinese economic crash and stress in their real estate sector are adding additional stress to markets, keeping Dollar high and Asian markets jittery.

- India’s forex reserves dropped for the third consecutive week, declining by $2.417 billion to $601.453 billion as of August 4, according to the latest RBI data. In the week ended August 11, the rupee moved in a range of 18 paise as FPI bought dollars along with oil companies and ensured the rupee remains at lower levels while RBI protected it from further depreciation by selling dollars.

What lies ahead?

The rupee spot (CMP: 82.98) remains vulnerable, amid rising long-term US Yields

- The calendar is a little light this week, but the Fed Reserve minutes could keep the Dollar Index moving higher. Fed Reserve Policymakers stated this week that they haven’t even discussed any timeframe for rate cuts yet as there is still work to do. We expect this to be represented in the minutes with the Fed unlikely to show any significant signs of dovishness.

- Markets do appear to have bought into the ‘soft landing’ narrative despite some weakness in US equities this week. The Fed Funds probability has seen little change over the course of the week with markets still at a 88.5% probability that rates will remain at current levels in September with the probability for a December rate hike now at 30%.

- Retail sales data will give us further insight into the demand side in the US which has shown some moderation over the past few months. A further drop in retail sales could give an indication that a recession may materialize despite being positive from an inflation perspective as less demand should result in a drop in prices.

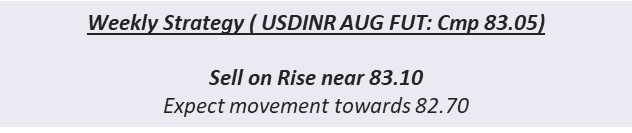

- USDINR is moving towards the higher end of the current range and might breach 83 temporarily. Unless there is a blow-up in any of the potential landmines in the current market, it is unlikely that USDINR could sustain above 83 for a long.

- Indian indices are also set for a red start to the week as Chinese concerns weigh on markets. Chinese data is in focus this week, as are US retail sales and Fed minutes. Given that inflation is behaving as expected, markets are now focusing on the US government borrowing pressure, after Fitch highlighted the problem through their downgrade of the US credit rating. A rise in US yields, especially the longer end, is detrimental to the real estate sector, which is already in stress.