- The rupee gained on Friday on likely help from the Reserve Bank of India but registered a weekly decline for the second consecutive week as strength in the US dollar and elevated crude prices weighed on the INR.

- Elevated crude oil prices, higher US treasury yields, and strength in the dollar index weighed on the rupee through the week but some softness on Friday offered respite.

- The rupee was perched below 83 in early afternoon trading but aggressive dollar sales from a large state-run bank, likely on behalf of the RBI, strengthened it beyond that level. Despite the RBI intervention, global pressures and importer demand for dollars at these levels will cap the rupee’s appreciation at around 82.70-82.80.

- In addition to intervening in the spot and the non-deliverable forwards (NDF) markets, the RBI’s defence of the rupee has also likely extended to currency futures.

- India’s price data will likely show inflation in August edging down to 7.1% from a year earlier, following July’s surge to 7.4%. The slowdown would reflect a retreat in tomato prices from the record set early in the month due to fresh arrivals and government subsidies.

- Inflation should drop below the Reserve Bank of India’s 6% target ceiling in September as prices of the cooking staple continue to decline. We expect the RBI to lend support to the recovery by keeping the repo rate on hold at 6.5% through 1Q24, before starting to cut in 2Q24. The data are due Tuesday.

- India’s forex reserves halt a 2-week losing streak, jumping by $4 billion to $598 billion. With this, forex reserves halted a two-week losing streak and an increase of $4.04 billion from the previous week, recording the biggest gain in nearly two months.

The Dollar Index gained to 105.09, up by 0.82% last week against the previous week’s close of 104.24

- In a week gone by significantly, Dollar asserted its dominance, closing as the top performer and pushing the Dollar Index hovering close to a pivotal medium-term resistance zone. The Dollar Index has notched its 8th consecutive week of gains, marking its longest winning streak since 2014 and closing at its highest point since March.

- The narrative that the Fed might persist with its high-interest rates for an extended period is gaining traction. Last week’s data release displayed unexpectedly strong performance by the US services sector in August, characterized also by robust employment and price readings. Moreover, initial jobless claims decreased to their lowest point since February, pointing the sentiment towards positivity.

- Although the consensus anticipates a pause from the Fed, discussions are widespread, with bets on another rate hike this year lingering around a 50-50 chance. Additionally, the central theme is beginning to shift to the duration for which current restrictive interest rates should be upheld to ensure to achievement of the 2% target inflation level, completing the last mile of disinflation.

- Turning our attention to the forthcoming FOMC meetings, investors anticipate no change in the policy stance in September, but November with a 43.6% probability assigned to a 25 bps hike. This likelihood may increase in the days ahead, particularly if the upcoming US inflation report reflects higher inflationary pressures.

What lies ahead?

The rupee spot (CMP: 83.02) remains vulnerable but the broader range is intact, focus on US & Indian CPI data

- Over the past week, market sentiment concerning the USA has begun to waver. The sentiment was positive one week ago as data seemed to show the US economy was cooling down, removing the need for any further rate hikes by the Fed. However, there is now a growing feeling, supported by the latest releases of US economic data, that the US economy is not cooling sufficiently, and that CPI (inflation) data due this week will show a continuation of rather than a reduction in inflationary pressure. This could make it more likely that even if the Fed does not hike rates at its meeting later this month, it may do so at its subsequent meeting in November.

- Markets will be looking ahead to the releases of US CPI data this week, and the policy meeting at the ECB. YoY inflation is expected to rise again from 3.2% to 3.6%, while the ECB is expected to keep its interest rate on hold at 4.25%.

- For the Dollar Index, the pivotal resistance zone of 105/106 is expected to be a decisive territory that could shape the medium-term outlook for the index.

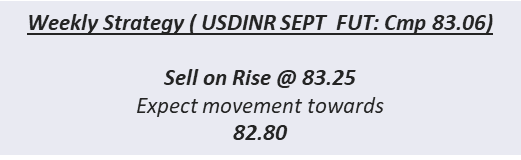

- qRupee remains vulnerable to long-term trends as the impact of higher US long-term yields seeps into global markets in the coming months. In the immediate term, as long as the Rupee remains between 82.80 and 83.30, the long-term up move in USDINR remains in abeyance. How long will the Rupee be able to hold against the rising US 10y is the key question now. With Oil also firm, the pressure on the Rupee could remain for the foreseeable future.