- Indian rupee erased the previous week’s gain and ended the week with a loss of 9 paise or 0.10% to 83.39 a dollar amid weaker regional currencies and a stronger dollar following upbeat US economic data. On the local front, RBI’s status quo policy has not impacted USDINR one bit.

- The global financial markets last week were primarily influenced by three pivotal themes: the Yen’s dramatic rise, the Dollar’s strength following robust US employment data, and the repercussions of Moody’s downgrading China’s rating outlook.

- The solid labour market report led traders to reconsider their expectations for an early rate cut by the Fed. On the positive front, India’s FX reserves surged to $604.04 billion as of Dec.1, rose for a third straight week and stood at a more than four-month high, data from the RBI showed on Friday. The foreign fund inflows and stronger domestic macro can lead to steady price actions in the local rupee even in global uncertainty.

- The crude-market strength has softened to the weakest since June as an influx of US cargoes threatens to flood global markets. If US supplies outstrip Asian demand, the barrels may find their way to Europe, worsening the glut and deepening the discount for near-term barrels.

- USDINR has been boxed in by structural demand and RBI intervention possibility on one side, and the reversal in Dollar strength on the other side.

The Dollar Index gained to 104.21, up by 0.72% last week against the previous week’s close of 103.27

- The dollar secured its position as the second strongest currency, buoyed by robust employment and upbeat consumer sentiment data. The solid labour market report led traders to reconsider their expectations for an early rate cut by the Fed.

- Non-farm payroll report released on Friday provided a glimpse into the robustness of the US job market. The report exceeded expectations with a headline job growth of 199k, while the unemployment rate fell unexpectedly to 3.7%. Furthermore, wages continued to grow at a strong pace of 0.4% mom. These figures suggest that the US job market remains tight, with ongoing robust wage growth indicating that inflationary pressures might persist longer than some market analysts had anticipated.

- A soft landing for the United States is still on the cards, although uncertainty around the Federal Reserve’s monetary tightening path clouds the outlook. China’s growth is expected to weaken, as global companies look for alternative locations to reduce their reliance on the country for services such as manufacturing.

- Holding rates seems a done deal, with investors laser-focused on comments from Chair Jerome Powell that could indicate when the Fed might look to cut rates after 525 basis points of increases since March 2022.

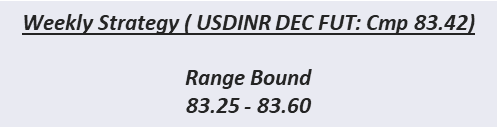

Rupee spot (CMP: 83.38) continues to be range bound Unless surprise triggers.

- This week is a data and event-heavy one, with central bank decisions and inflation data in focus. US CPI/PPI, FOMC, ECB and BOE decisions are due this week. The rupee is unlikely to break the current behaviour unless the US CPI comes completely off the charts.

- Despite these positive indicators, the market still heavily anticipates the Fed to maintain steady interest rates, with a 97.1% chance at its final policy meeting of the year. However, the likelihood of a rate cut in March has reduced, with expectations falling to 44% from 55% just last week.

- Markets are still in the “bad news is good news” paradigm as bad news can bring in rate cuts. It is a matter of time before the narrative turns, leading to some caution in markets. We expect that the Q1 of 2024 could see starting signs of a recession, followed by signs of credit and liquidity issues, compelling the Fed to cut rates by the second half.

- USDINR is geared more towards depreciation than strength. The short-term potential for a USDINR move towards 83 levels remains tangible, but the probability of such a move diminishes with a day of the absence of a meaningful reaction from the Rupee to the global Dollar weakness.

- Meanwhile, RBI is the strong holder of the Rupee. Reserve Bank of India likely sell dollars to curb losses in the rupee, as the currency is trading near its lifetime low. The currency had previously hit a lifetime low of 83.42 on Nov 10. The RBI is likely to keep protecting, the rupee near these levels.