- Indian rupee retreated in the week gone after marking two weeks of gain following month-end dollar demand and profit booking by the foreign institutions in the equities. The strength in the dollar index after FOMC and weaker Asian currencies also weighed on the Rupee. Going ahead, the focus will remain on the dollar flows and price action in regional currencies

- A rise in oil prices was cited as another reason for the rupee’s fall this month. Brent crude futures, up about 12.5% this month, are headed for their best performance in more than a year.

- USDINR forward premiums barely changed month-on-month, with the 1-year implied yield at 1.66% amid possible sell/buy swaps by the RBI and a dovish Fed outlook.

- The rupee twice this month hit the 81.70-81.75 range, following which it had to contend with the RBI. The central bank bought dollars around that level via public sector banks to prevent the rupee from appreciating more. With the RBI “not in a mood to relent,” the rupee looks confined to an 81.70-82.60 range for the time being.

- India’s forex reserves declined by $1.9 billion to $607.03 billion in the week ended July 21, according to the latest RBI data. In the previous week ended July 14, the forex reserves had swelled by $12.743 billion to cross the $600 billion mark. The foreign currency assets, a major component of the reserves, fell $2.41 billion to $537.75 billion

Dollar Index gained to 101.62, up by 0.55% last week against the previous week’s close of 101.07

- The dollar initially weakened after the event but rebounded with help from stronger-than-expected Q2 GDP data. Yet it failed to extend gains towards the end of the week. Softer US inflation readings have prompted investors to bet that this month’s Fed rate hike will be the last.

- The US Dollar has enjoyed a mixed week, to say the least, but remains on course for a weekly gain. Friday’s data out of the US was a mixed bag as well with a slight miss for the Michigan Consumer Sentiment print but Core PCE data showed promising signs slowing faster than expected.

- Fed’s rate decision was largely as expected. A rate hike of 25bps was delivered, with the accompanying statement almost a carbon copy of June’s. Chair Jerome Powell’s left the door open for another rate hike in September, without giving any indication of preference.

- The Core PCE data of course is the most telling given that it is the Fed’s preferred inflation gauge. A drop of 0.5% from the May print has only further added to hopes that the Fed is likely done with regard to the current hiking cycle. This coupled with labour costs rising at their slowest pace in 2 years could explain some of the weakness in the US Dollar on Friday.

What lies ahead?

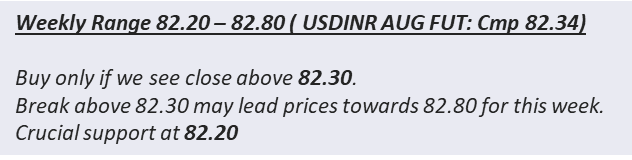

Rupee spot (CMP: 82.27) Comfortable in its zone, but with slight depreciative bias, amid a US data-dependent approach.

- With Asian currencies doing well to begin the week and risk holding up, the rupee will be hoping for a mini recovery. But USDINR remains in an unchallenged range. This week is loaded with data such as US ISM and non-farm payroll. The data points might not be enough to get Rupee to break the range on either side

- We expect the USDINR in a range of 81.80-82.20 this week, with moves in the Chinese Yuan and “high-impact” US data considered to be the important variables.

- Heading into next week and the DXY is delicately poised heading into the second month of Q3. The ongoing narrative for a soft landing could end up hurting the US Dollar moving forward if US equities continue to rise.

- This week will bring updated jobs and NFP data which will give us another snapshot at the health of the US economy. Average hourly earnings will once more be a key gauge for the Fed as strong wage growth has been touted as a problem in the ongoing inflation tussle.

- qISM data is also expected in the week ahead with services as always likely to hold a bigger sway given the US economy is primarily service driven. However, the ISM manufacturing data may hold more weightage in the week ahead after the recent PMI data not just in the US but globally showed significant signs of a slowdown. With that in mind, a significant miss to the downside could rekindle some recessionary fears even if it may be short-lived. This has been a theme of 2023 thus far with the constant shifting of sentiment during high-impact data and risk events.