Rupee appreciated to its highest level in last 4-months amid softness in the dollar and strong capital flows to the domestic markets.

Rupee started the week on a strong note after the Bloomberg Index Services on Monday proposed to include eligible Indian bonds in its emerging market local currency index from September.

Further, better than expected advance GDP numbers which showed a growth of 7.3% in the fiscal year 2023-24 strengthened the rupee to hit the 82.80 mark.

The December narrowing of India’s trade deficit, along with portfolio capital inflows, is creating upward rupee pressure

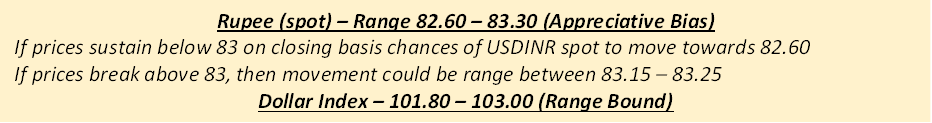

Rupee outlook

Rate cut expectations remain firm but slightly dented as stronger inflation and tight labour market continue to surprise markets.

USDINR is below 83 but without any momentum further. Dollar has been picking up some strength due to the slight doubt about the rate cut timings which has crept in after the last inflation data. Even though the Rupee remains at an advantage, the shifting Dollar momentum could cap Rupee upside in this move.

On a fundamental basis, the bias will be towards rupee appreciation. The Reserve Bank of India is expected to lag the Federal Reserve in the timing and quantum of interest rate cuts, helping widen the India-US yield gap.

Dollar Index gone by

Dollar demonstrated a distinct lack of decisiveness in its trading last week, encapsulating a theme of uncertainty that has become characteristic since the start of the year.

Rate cut expectations remain firm but slightly dented as stronger inflation and tight labour market continue to surprise markets.

Dollar has been picking up some strength due to the slight doubt about the rate cut timings which has crept in after the last inflation data.

Dollar index Outlook

Dollar has been witnessing lack of clear direction, oscillating between brief rallies and selloffs without establishing a sustained trend. This indecision in Dollar’s movement is largely attributed to the mixed signals from recent economic data and the uncertainty surrounding Fed’s monetary policy path for the year ahead.

The anticipation of Fed’s monetary policy path remains a central theme. Fed fund futures have been aggressive, pricing in over 80% likelihood of a rate cut as early as March, with an expected total easing of 1.50% by the end of 2024.