NRI

Offering services to Non-resident Indians to invest in India from anywhere across the world. We offer multiple products to NRIs both in primary and secondary markets. There are multiple platforms available for trading and investment.

Features of NRI Account

Seamless zero hassle trading account

Invest in the primary and secondary market with NRE and NRO account through single login access with wide range of products

Automated Tax Settlement

Payout will be credited in your NRE/NRO bank account post deduction of applicable taxes

Real Time Portfolio Tracking

Our trading platform and mobile app will help you track your portfolio real time

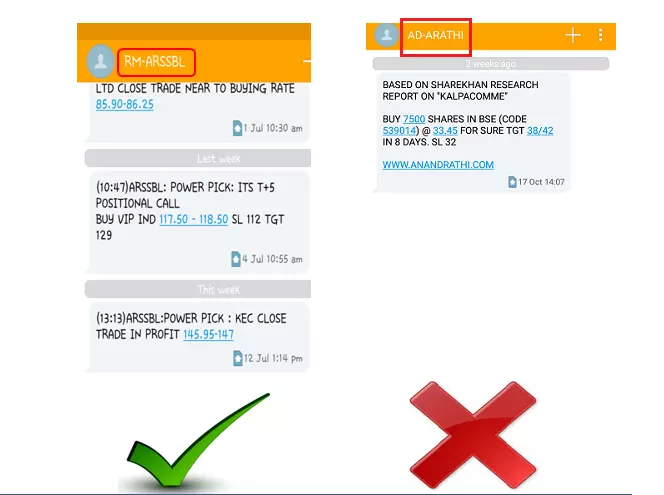

Research & Advisory

There is a wide range of research reports which help you choose right stocks for your long term & short term investments to get maximized return on your investment

Setting off losses

Short term losses will be adjusted in same financial year to minimize your tax deducted at source

Types of NRI Accounts

NRE PIS

For buying and selling shares in indian Stock Market under PIS on repatriable basis

NRO PIS

For buying and selling shares in indian Stock Market under PIS on non-repa-triable basis

NRE NON PIS

Investment into Mutual Funds, ETF or IPO under Non PIS on repatriable basis

NRO NON PIS

Investment into Mutual Funds, ETF or IPO under Non PIS on non repatriable basis & trading in Futures & Options

How to Open an Account

Product Offering

Regulations

NRI Clients can do only delivery based trading, intra day trades or daily square offs are not allowed for NRIs

NRIs are allowed to invest in Indian Stock Market under the Portfolio Investment Scheme (PIS) through secondary market.

All trades done by NRIs are to be reported to Authorized Dealers within 24 hours which is taken care off by broker that is, Anand Rathi Shares and Stock Brokers Limited.

There is a ceiling of purchase under PIS for investments on repatriable basis. Once the ceiling is breached the stock is blocked by RBI for NRI trading. This scripts is re-opened for trading once the holding percentage of NRI's drops down.

Trading in Futures and Options can only be done on non-repatriable basis only through NRO account.

Tax Implication

As per regulatory guidelines, Tax (if applicable) has to be deducted at source for all the profits done in the equity market transactions by NRIs.

Capital gains are profits arising from sale of shares. Long term capital gains is profit made out of selling of shares held for more than 1 year and short term capital gains is for shared held for less than 1 year.

The applicable tax would be deducted for equity and futures & options based on long term or short term capital gains. While there would be no tax on losses.

Tax amount deducted will be reflected on your bank statement and in TDS certificate issued by the Bank

Note:

Note: